Located in the heart of Sheffield City Centre, Langford Tower is a newly renovated residential development, offering investors a rare opportunity in one of the city’s most sought-after postcodes. This 24-storey landmark building comprises 97 apartments (a mix of studios, one-bed, and two-bed units) finished to a high standard.

With prices starting from around £140,000 for a studio flat, Langford Tower presents an accessible entry point into a high-growth property market. Its combination of prime location, modern amenities, and strong market fundamentals makes Langford Tower an attractive prospect for both local and international investors.

Check out our Langford Tower property at our properties.

Langford Tower boasts a perfect location on St. Mary’s Gate along Sheffield’s Inner Ring Road, placing it conveniently between The University of Sheffield and Sheffield Hallam University campuses. This means a huge student and young professional catchment area is on the doorstep, ensuring rental demand year-round.

The development is also within walking distance of key city amenities and entertainment, the popular Moor shopping district (with its Moor Market and a large Waitrose supermarket) is just a few minutes’ walk away, and residents have easy access to numerous restaurants, cafés, and cultural venues in the city centre.

Major transportation hubs are close by as well, Sheffield’s central train station and bus interchange can be reached within minutes, making the location ideal for commuters and students alike. Beyond convenience, the locale offers an attractive lifestyle that will appeal to tenants. 谢菲尔德 is celebrated for its vibrant arts and music scene and a lively nightlife catering to the city’s large student population and growing professional class.

At the same time, it’s one of the greenest cities in Europe, boasting over 250 parks and woodlands and proximity to the scenic Peak District National Park. Sheffield even ranks among the safest cities in the UK, enhancing its appeal for young professionals and families.

This blend of urban culture and outdoor recreation means Langford Tower’s residents can enjoy an excellent quality of life, a significant consideration for investors aiming to attract and retain high-quality tenants.

Investors will be pleased to note that Langford Tower offers state-of-the-art facilities designed to meet modern renters’ expectations. The building has been fully refurbished by the renowned developer Select Group, ensuring that each unit and common area meet contemporary standards.

Residents benefit from amenities like a hybrid co-working space and private work pods for remote working, stylish lounge areas for relaxation and socialising, and even a dedicated games room for leisure.

A concierge service is provided, adding convenience and security for residents. Such on-site facilities create an upscale, community-oriented living environment that is highly attractive to young professionals and students seeking more than just a basic flat. Inside the apartments, high-specification finishes and thoughtful design are evident. Each unit features a fresh, chic décor with open-plan layouts that maximise space and light.

Floor-to-ceiling windows not only flood the interiors with natural light but also frame stunning panoramic views of the Sheffield skyline and surrounding hills. Units come with modern fitted kitchens and bathrooms, offering a turnkey, ready-to-move-in product for tenants.

It’s no surprise that the development has been approved for short-term rentals, indicating further flexibility for investors.

As of early 2025, average house prices in Sheffield have risen about 6.7% year-on-year, reaching approximately £221,000. This rate of growth not only outpaces the broader Yorkshire & Humber regional average, but it also positions Sheffield among the UK’s fastest-growing property markets in terms of price increases.

Notably, Sheffield property remains comparatively affordable versus nearby major cities (for example, average prices in 利兹 and 曼彻斯特 are £240k–£265k+), which suggests room for further growth as the city catches up to its peers.

Looking ahead, industry forecasts predict substantial capital growth for Sheffield investments. According to market analyses, Sheffield’s property values are expected to climb by anywhere from 21% to 28% over the next five years. In fact, projections are roughly a 28% price increase by 2028–2030, driven by Sheffield’s strong economic fundamentals and housing shortage.

Sheffield is currently in the midst of a third wave of regeneration, which has already helped the local economy expand by over 150% since 2000 (with GDP now around £19 billion as of 2024). As regeneration projects (like the £470m Heart of the City II development) continue to enhance the cityscape, property values in central locations stand to benefit from the infrastructure and increased business activity.

The city’s population has been on a steady rise, growing from about 513,000 in 2001 to roughly 580,000 by 2024, and is projected to reach 630,000 by 2040. This sustained population growth, particularly the influx of students and young professionals, brings constant pressure on housing.

Sheffield is home to over 65,000 university students and retains a large portion of its graduates each year, fuelling demand for quality rental accommodation in the city centre.

An estimated 42% of Sheffield’s graduates choose to stay and work in the city after finishing university, a testament to the career opportunities and lifestyle on offer. For landlords, this means a deep tenant pool and low void periods, especially for well-located, modern apartments like Langford Tower. Sheffield is a dynamic university city with a growing population of young professionals, ensuring strong tenant demand for central properties. Compounding this demand factor is Sheffield’s chronic undersupply of new housing.

Residential construction has consistently lagged behind needs for over a decade. Between 2011 and 2020, only around 760 new dwellings were built per year on average, far below the council’s target of 2,200+ units. This shortfall has created an accumulating deficit of homes. By 2032, Sheffield is forecast to be over 14,800 units short of what its population will require. Such an imbalance between demand and supply puts upward pressure on both rents and property prices.

Investors in Langford Tower can therefore expect a healthy rental market. Current rental yields in Sheffield are very attractive, commonly in the 5%–6.6%+ range for city centre apartments. The combination of high tenant demand and limited competing supply, especially for newly refurbished units in prime locations, should translate into excellent occupancy rates and the potential for rental growth in the years ahead. These figures are based on management data from Complete Prime Residential Limited, one of IP Global’s sister companies overseeing the development.

Langford Tower is ideally suited to investors seeking a low‑maintenance, high‑demand property in a thriving UK city. Its central location, contemporary design, and proven rental appeal make it a standout choice for a range of investment strategies.

Ultimately, whether your goal is consistent rental income, long‑term capital growth, or both, Langford Tower Sheffield is a rare investment that offers the fundamentals needed for success.

If you’re interested in Langford Tower or other high-potential opportunities in Sheffield, now is the time to act. Our team at IP Global are ready and can assist you in navigating this investment opportunity today.

Don’t hesitate to contact us for more information or to discuss how Langford Tower could fit into your investment portfolio. With a proven track record of delivering successful property investments across the globe, we offer the correct end-to-end service to make your investment journey smooth and profitable.

London’s property market in 2025 continues to attract investors seeking a blend of stable capital appreciation and robust rental income. While prime central postcodes still offer long-term prestige, they typically yield only about 2.5 - 3.0%. By contrast, many emerging outer boroughs and regeneration zones are delivering rental yields above 5%, well above the London average.

The key is knowing where the best place to invest in property in London is for both growth and yield. Below, we break down some of the best London property investment areas in 2025, highlighting their yield potential, regeneration drivers, and investment opportunities.

For more detailed property research from us, visit our London property investment research page.

Despite global economic fluctuations and rising interest rates, London remains a leading destination for property investors. The city combines global financial prominence, world-class education institutions, and an ever-growing population with significant housing demand.

In 2025, key drivers keeping London attractive include:

● Undersupply of housing relative to population growth.

● Continued regeneration in outer boroughs and along key transport corridors.

● Stable tenant demand among professionals, students, and international renters.

● Attractive yields in targeted areas well above the capital average.

Additionally, the introduction of the Elizabeth Line (Crossrail) has radically reshaped the map of property investment, bringing once-overlooked areas into focus.

Ilford, in the borough of Redbridge, has rapidly emerged as an East London hotspot thanks to major regeneration and transport upgrades. The opening of the Elizabeth Line (Crossrail) station in Ilford has dramatically improved connectivity, central London can now be reached in as little as 20 minutes, and is part of wider plans to “radically re-shape” the town centre. A £1 billion town centre renewal is underway, including the construction of 1,000 new homes (Ilford Western Gateway) and new community facilities to revitalise the area.

Ilford offers investors a compelling combination of affordability and growth potential. Prices remain modest compared to inner London, yet demand is rising from young professionals and families seeking value.

Rental yields in Ilford and surrounding Redbridge are above London averages, with many buy-to-let investors seeing gross yields around 5 - 6% in this area. This is supported by strong tenant demand. Ilford is especially appealing to commuting professionals thanks to the Elizabeth Line’s reduced travel times.

For example, IP Global’s Horizon development (launched in 2018) in Ilford achieved rents in 2024 at 135% of the originally forecast level, delivering a healthy gross yield of 5.3% for investors.

On the south bank of the Thames, Vauxhall and Nine Elms form one of Europe’s most ambitious regeneration zones. Covering 560 acres between Vauxhall and Battersea, Nine Elms has transformed from industrial land into a new riverside quarter, thanks to an estimated £15 billion investment in the local area.

The centrepiece is the restoration of the iconic Battersea Power Station (now home to Apple’s London campus and luxury residences). Two new Northern Line tube stations at Nine Elms and Battersea Power Station opened in 2021, dramatically improving transport, now it’s just 8 minutes to Westminster and 12 minutes to the City.

Despite its central location and high-ed buildings, Nine Elms property remains undervalued relative to traditional prime neighbourhoods. Over the 12 months to May 2025, prices in Nine Elms rose 7.5%, and analysts project further growth of 2.5 - 4% annually.

Rental yields in Vauxhall/Nine Elms are notably higher than in old prime Central London, up to 5.1% in certain new-build towers. For example, IP Global’s Keybridge Lofts development in Vauxhall (completed 2020) has achieved rents of around 23% higher than forecast, translating to a 2024 rental yield of 4.1%.

Greenwich Peninsula has rapidly become one of London’s most promising investment hotspots, driven by exceptional rental growth and large-scale regeneration. Since 2019, the area has experienced average rental growth of 37%, outperforming many other parts of the capital. This growth is underpinned by the ongoing £10.8 billion regeneration project, one of the largest in Europe, which is transforming the Peninsula into a vibrant residential, cultural, and commercial destination.

This regeneration includes the creation of 17,500 new homes, a design-led creative district, new schools, green spaces, and improved transport links. For investors, this makes the area especially attractive for long-term capital appreciation and consistent yields.

Peninsula Riverfront is ideally positioned within this riverside location. The development provides premium access to the Thames, modern architecture, and proximity to North Greenwich station, making it an excellent opportunity for those looking to capitalise on the area's growth.

Canary Wharf in East London’s Docklands is an established powerhouse that remains one of London’s best property investment areas for solid rental yields and future growth. Once purely a weekday business district, Canary Wharf has diversified with new residential towers, shops, parks, and leisure options, creating a vibrant 24/7 neighbourhood. It’s home to over half of the world’s top 50 banks and major firms in finance and tech.

Importantly, the new Elizabeth Line (Crossrail) has slashed travel times, and Canary Wharf is now only 13 minutes from the West End. Rental yields in Canary Wharf average around 5% - 5.5%, among the highest in London. Strong tenant demand also ensures high occupancy and rental growth, perfect for investors of all levels.

One notable development in the area is Royal Victoria Residence, located near Canary Wharf in the Victoria Docks. Completed in 2018, it currently delivers a strong rental yield of 4.11% and an impressive 113% achieved vs forecasted rent (based on year-end 2024 data). These figures are based on management data from Complete Prime Residential Limited, one of IP Global’s sister companies overseeing the development.

Once overlooked, Woolwich has become one of London’s most exciting emerging areas. The arrival of the Elizabeth Line has slashed travel times, just 8 minutes to Canary Wharf and under 15 to Liverpool Street.

This transport transformation is being matched by a major regeneration push, including Royal Arsenal Riverside, a large-scale mixed-use project bringing new homes, green spaces, and retail units to the area. Woolwich is also seeing investment in town centre upgrades and cultural venues.

All of this is becoming very attractive to investors as the area continues to see continued levels of investment.

Rental yields here are currently 5.5% or higher, making it one of the top-performing areas for landlords. Demand is rising rapidly from commuters and key workers looking for affordability and an overall feeling of convenience.

Croydon is in the midst of a £5.25 billion regeneration programme that is transforming it into a dynamic urban hub. Often referred to as South London’s second city, it’s attracting new tech employers, co-working spaces, and a wave of residential development that is reshaping the local landscape.

With fast rail connections, including journeys of just 15 - 20 minutes to London Bridge or Victoria, alongside proximity to Gatwick Airport and one of the youngest populations in the capital. Although the long-anticipated Westfield shopping centre has seen delays, regeneration across the borough continues at pace.

Rental yields here reach up to 6%, among the highest in London, while property prices remain comparatively low. Both affordability and rising demand make Croydon a strong contender for buy-to-let investors seeking both quick returns and long-term growth potential.

One example is Emerald House, a completed development from IP Global delivering 4.5% rental yields and 117% achieved vs forecasted rents as of year-end 2024. The project was completed in 2017 and continues to perform well in the current market. These figures are based on management data from Complete Prime Residential Limited, one of IP Global’s sister companies overseeing the development.

Beyond these five key areas, other London locations are showing strong potential in 2025:

Tottenham Hale – Major regeneration via the £6bn Meridian Water scheme and increasing rental demand.

Hayes & Southall – West London locations benefiting from Crossrail connectivity and strong yields (5.5 - 6%).

Stratford – Still gaining traction post-Olympics with new housing and commercial growth.

These areas, combined with those where IP Global has a proven investment track record, reflect the best London property investment areas for 2025. As the capital continues to evolve, strategic investment decisions based on regeneration, transport, and rental potential are key to long-term success.

Interested in capitalising on London’s most promising property investment opportunities? At IP Global, our research-driven approach ensures you invest with confidence, backed by local insights and proven performance.

Explore our available opportunities and speak to an advisor via our contact us page. Learn more about our team and how we support investors through every step of the journey.

Wondering what Greenwich is like and why it’s capturing the attention of homebuyers and investors across London? With a blend of historic charm, idyllic riverside living, and new developments, Greenwich offers one of the most balanced lifestyles in the capital. From the maritime heritage of Greenwich Town Centre to the modern Greenwich Peninsula, the area has both cultural depth and growth prospects.

Whether you're curious about what to see in Greenwich Peninsula, including The O2, Design District, or riverside art trails, or just exploring what to do in the Greenwich Peninsula, including weekend markets, music events, and park strolls, there’s something for everyone.

In this blog, we’ll explore why Greenwich stands out as one of London’s top locations for both lifestyle and long-term property investment.

Greenwich is certainly a unique place to live in London. For those wondering what Greenwich is actually like, it's a vibrant neighbourhood where historic old landmarks sit alongside London's architecture and culture.

Living riverside in Greenwich offers stunning views of the Thames, peaceful walking routes, and direct access to some of London’s most scenic green spaces. The neighbourhood features a mix of natural beauty and urban convenience, offering a riverside lifestyle steeped in heritage while maintaining the amenities of urban living.

Greenwich has one of the richest histories in London, making it a truly unique place to live and explore. As the birthplace of Henry VIII and home to the Old Royal Naval College, designed by Sir Christopher Wren, the area’s royal and maritime legacy is woven into the architectural fabric of the neighbourhood. Just a short walk away sits the Royal Observatory, where Greenwich Mean Time (GMT) was established, marking the area’s global importance in navigation and timekeeping.

The Greenwich Market, dating back to the 1700s, remains a vibrant hub of independent traders, artisans, and food vendors, offering a taste of tradition in a modern setting. What makes Greenwich truly special is how these iconic historical landmarks sit alongside sleek residential developments, creative spaces like Design District, and attractions on the revitalised Greenwich Peninsula. This mix of old and new defines what Greenwich is like today, a neighbourhood where centuries of heritage enhance the appeal of urban living.

Greenwich has a village-like energy that mixes the calm of the riverside with cultural vibrancy, attracting creatives, professionals, and families alike. The unique vibe that Greenwich possesses creates a positive atmosphere and a perfect neighbourhood for settling down or for investment.

Greenwich is home to some of London’s most iconic green spaces, including the expansive Greenwich Park, which offers panoramic city views and a peaceful escape from urban life. These lush outdoor areas are a key part of what Greenwich is like, providing plenty of open space for walking, cycling, and relaxing just minutes from the cultural and modern attractions of the Greenwich Peninsula.

Greenwich is certainly a cultural hotspot. Whether you're exploring centuries of British history or catching live performances and exhibitions on the Greenwich Peninsula, the area offers a vibrant mix of traditions that define what Greenwich is like today.

When contemplating what to do in Greenwich Peninsula, the neighbourhood’s rich vein of museums and heritage must be considered. Greenwich is home to several museums, including the National Maritime Museum, which showcases Britain’s naval heritage, and the Royal Observatory, offering a fascinating journey through astronomy and timekeeping.

These cultural institutions offer fantastic local cultural and historical experiences, shedding light on the history and heritage of Greenwich.

Greenwich is a vibrant music destination, anchored by The O2 Arena on the Greenwich Peninsula, where world-famous artists and live concerts draw crowds all year round. Complemented by intimate venues, local gigs, and community events, the music scene blends global entertainment with a friendly local vibe and riverside charm.

Greenwich has a solid sports scene that caters to both casual enthusiasts and serious athletes. From rowing clubs on the River Thames to tennis courts and cricket pitches in Greenwich Park, sports are abundant in the Greenwich area.

There are also opportunities to watch professional live sports at The O2 Arena, as the venue often holds large sporting events such as the British Basketball League Playoff Finals.

Greenwich now has excellent transport links, making it one of London’s most well-connected neighbourhoods for commuters and residents alike. With access to the DLR, Jubilee Line, Southeastern rail services, and the Thames Clipper riverboat, getting to Canary Wharf, London Bridge, or the West End is quick and convenient.

Greenwich is well-connected to the London Underground network, offering easy access via the Jubilee Line at North Greenwich station and the Docklands Light Railway (DLR) at Cutty Sark and Greenwich stations. These fast and reliable transport links provide direct routes to key destinations like Canary Wharf, London Bridge, Bank, and Stratford, making commuting effortless. Moreover, it also connects Greenwich with Central London, creating strong links with the rest of the city.

Greenwich offers quick and easy access to both Canary Wharf and Central London, making it an ideal location for professionals and visitors alike. With excellent transport links via Jubilee Line DLR, rail, and the Thames Clipper, Greenwich is the perfect base for exploring and commuting into London.

Peninsula Riverfront is an exciting new riverside development on Greenwich Peninsula, offering beautifully designed living from studios, 1/2/3-bedroom to penthouse apartments, with striking views across the River Thames and the London skyline, with a sleek glass frontage and idyllic roof terrace.

With just a 2‑minute walk to North Greenwich Station (Jubilee Line), Peninsula Riverfront offers quick connections to Canary Wharf (2 min), London Bridge (8 min) and the West End (17 min), making it one of the most well‑connected and stylish riverside communities in London.

Peninsula Riverfront has a luxurious riverside living experience with exclusive resident perks that blend wellness, leisure, and productivity. Residents can unwind with an evening swim in the 15th-floor swimming pool overlooking the Thames, followed by a session in the state‑of‑the‑art gym or steam room. Social life flourishes in stylish cinema and multimedia rooms, co‑working lounges, private dining and function rooms, as well as furnished rooftop terraces perfect for hosting or relaxation.

Peninsula Riverfront offers a compelling investment opportunity within the wider £10.8 billion Greenwich Peninsula regeneration project, a transformative 150-acre riverside overhaul. With JLL forecasting a robust 21.6 % house price growth across Greater London between 2025 and 2029, Greenwich Peninsula is expected to outperform regional averages; therefore, buyers at Peninsula Riverfront are set to benefit substantially.

The rental market is equally strong, with 37 % average rental price growth across the Peninsula since 2019, and Peninsula Riverfront specifically offering gross rental yields of up to 6.4 %, making it a prime choice for investors seeking healthy income and long-term investments.

Greenwich is no longer just a lifestyle destination, it has firmly established itself as one of London’s most strategic property investment locations in 2025. Driven by a mix of cultural heritage, modernisation, and regeneration, the area offers both capital growth potential and strong rental performance.

The Greenwich Peninsula regeneration project, valued at £10.8 billion, continues to transform the area with new residential, retail, leisure, and public spaces, reshaping the local economy and attracting long-term residents and professionals. Demand for high-quality homes in the area has increased sharply in recent years, supported by new infrastructure and an expanding local population.

From an investment perspective, Greenwich delivers on all fronts, strong commuter appeal via DLR, Jubilee Line and riverboat services; ongoing urban regeneration; rising rental demand; and a growing creative and tech scene. With average gross rental yields of 5 - 6.4% in key developments like Peninsula Riverfront and forecast house price growth of 21.6% in Greater London by 2029, Greenwich is well-positioned to outperform.

IP Global have a pristine track record for market experience, with a gross development value of over £1.4 billion since 2009 in the U.K. alone.

联系我们 today for more information on our lucrative property investment opportunities.

For years, London and the South East have dominated the UK property investment landscape. However, a significant shift is underway as investors increasingly turn their attention to the North of England. With more affordable property prices, higher rental yields, major regeneration projects, and strong economic growth, the North has become a hotspot for savvy property investors.

This blog explores why the North of England is attracting more investment, the best cities to consider, and what makes this region a promising long-term opportunity for property investors.

One of the key reasons property investors are looking North is affordability. London property prices have soared to levels that make it difficult for many investors to enter the market, with average house prices well above £500,000. In contrast, cities like Manchester, Liverpool, Leeds, and Newcastle offer significantly lower entry points.

Investors can buy multiple properties in the North for the price of one in London, diversifying their portfolio and spreading risk more effectively.

Rental yields are a crucial factor for buy-to-let investors, and the North of England offers some of the best yields in the UK. While yields in London often struggle to exceed 3-4%, cities in the North consistently achieve 6-8% or more.

For example:

These higher returns make the North particularly attractive to property investors looking for strong rental income.

Investment in Northern cities is booming, with billions being poured into regeneration and infrastructure projects that are transforming city centres and surrounding areas. These improvements increase property values and rental demand, making them prime locations for investors.

Some of the major projects include:

These projects not only drive demand for housing but also attract businesses and skilled workers, further fuelling the property market.

Northern cities are no longer just industrial hubs; they are becoming key economic centres with booming industries in technology, finance, healthcare, and media. This has led to strong job growth and an influx of young professionals seeking rental accommodation.

A robust economy means higher demand for housing, ensuring property investors can find tenants quickly and benefit from long-term capital growth.

The North is home to some of the UK’s top universities, including:

These institutions attract tens of thousands of students each year, creating a constant demand for rental properties. Purpose-built student accommodation and HMO (House in Multiple Occupation) investments are particularly profitable in these cities, often yielding over 8% per year.

While property prices in London have stagnated or even declined in recent years, Northern cities continue to show strong capital growth. Recent data suggests that house prices in Manchester, Leeds, and Liverpool are rising at a faster rate than in the South.

This capital appreciation makes the North not just a short-term rental yield opportunity but a long-term wealth-building strategy.

The UK government continues to push investment into the North through policies such as:

Government backing adds an extra layer of confidence for investors looking to buy in the region.

The North of England has emerged as one of the best place to invest in UK property, thanks to its affordability, strong rental yields, economic growth, and long-term capital appreciation potential. Cities like Manchester, Liverpool, Leeds, Sheffield, and Newcastle are proving to be the most attractive investment destinations, offering investors a chance to secure high returns without the financial burden of London’s inflated property prices.

With continued regeneration, a strong job market, and government support, the Northern property market is expected to thrive for years to come. For investors looking for the best opportunities in UK real estate, the North is undoubtedly the place to be.

In the face of fluctuating house prices and shifting market dynamics, it's never been more crucial to choose your properties carefully and conduct thorough market due diligence.

Luckily, we have already done this research for you and compiled a list of the best places to invest in property.

To ensure we’re providing the best property investment cities we have utilized insights from leading industry reports by CBRE, Knight Frank, PWC, and the latest research from Oxford Economics to identify resilient markets with the potential for sustained growth.

Over the last two decades, we have brought to market, developments in over 45 cities across 18 countries. In 2025, our focus is on three countries, but predominantly, the UK.

It has one of the largest GDPs in the world, strong population growth and house prices have risen 183% over the last 20 years due to a critical undersupply of homes. The UK is home to some of the best property investment cities in the world.

We choose our cities for their strong economic fundamentals, reputable developers, and low-risk profiles, and we’re happy to say the research has paid off - according to the latest House Price Index from Zoopla, we are active in 8 of the top 10 UK markets currently experiencing price growth, despite the general market volatility and declines elsewhere.

In 2025, the UK real estate market faces multiple challenges. Higher than typical interest rates, issues with affordability, and geopolitical tensions are the most notable factors across the country. However, individual cities pose their own additional challenges –but also, present opportunities.

We often receive inquiries about the best property investment cities where we are not currently investing. Given our research-driven approach, we think it's important to share our findings on the holistic UK market landscape to keep our investors well-informed to be able to make their own decisions, too.

Here we discuss the 12 key markets in the UK and the best places to invest in property that investors are most curious about in 2025.

Sheffield's transformation from a post-industrial city to a vibrant, cosmopolitan hub offers a compelling investment case, particularly in the property sector.

Since the 1997 labour government's economic initiatives, Sheffield has seen substantial regeneration, doubling its economy in size and attracting a diverse array of SMEs and new industries.

Sheffield has seen significant growth in sectors like finance, healthcare, and technology, ensuring a continuous influx of skilled workers.

The city also has a reputation for strong educational prospects, particularly at the University of Sheffield, which ranks 13th in the UK (Times Higher Education World Rankings 2024).

This demographic trend supports a strong rental market, especially as many graduates choose to remain in Sheffield.

Investment in Sheffield’s property market therefore offers stable rental yields, making it a smart choice for property investors and one of the best places to invest in property in the UK.

The ongoing demand for housing in Sheffield has been fuelled by a steady increase in population, currently estimated at over 568,960 residents.

The existing housing supply is unable to meet the growing demand, evidenced by projections of an 11,328-unit shortfall by 2035.

This imbalance is driving up property prices, making Sheffield particularly lucrative for investment in residential properties.

The city's strategic phase of regeneration emphasizes private sector-led growth, further enhancing its appeal as a forward-thinking and economically expanding city.

Take a look at our properties in 谢菲尔德.

Edinburgh, Scotland's capital, is celebrated for its rich cultural and historical significance, marked by its distinctive sandstone buildings and green spaces, earning it UNESCO World Heritage status.

The city plays a strong role in the UK's business and tourism sectors, bolstering a strong real estate market, driven by consistent population growth and robust economic performance.

The presence of global corporations (such as Amazon, Microsoft, and IBM) in Edinburgh have contributed to its attractiveness as a business centre and has supported a strong job market.

Edinburgh’s working population has increased by 21% in the last 20 years - 3 times more than Scotland’s average, and is currently the second most populous city in Scotland.

The population is expected to continue growing rapidly, and reach about 570,000 residents by 2035, a 27% increase since 2000.

Economically, 爱丁堡 has seen a significant increase, with its GDP expanding by 182% since 2000, reaching GBP33.1 billion in 2023. In the real estate sector, house prices have grown 49.3% since 2015, with a further increase of 17.6% projected between 2023 and 2027. Additionally, according to Zoopla, Edinburgh currently ranks in the top 20 UK markets experiencing price growth in 2025.

In early 2023, a rental cap was introduced in Edinburgh by the Scottish government due to spiralling rental price growth. But the policy has backfired and led to Edinburgh seeing some of the highest rental price growth across the UK.

Given that rental increases were limited by the cap during tenancies, landlords responded by hiking rents as much as possible at the start of new tenancies. This resulted in the policy quickly being scrapped as of March 2024 and the market still remains one of the strongest in terms of rental opportunities.

The combination of a growing economy, a strong job market, and increasing property values establish Edinburgh as one of the best property investment cities for property investors in the UK.

Browse through our properties in 爱丁堡.

Greater Manchester (encompassing ten metropolitan boroughs, including Manchester City, Salford and Trafford) has a total population of approximately 2.79 million (2023), which is forecast to rise to 2.96 million by 2030. This places it as the second most populous urban area in the UK after London.

Manchester’s position is solidified as a leading UK business hotspot and a top global city with a compelling case for property investment. It embodies a blend of strong, diverse career prospects, vibrant lifestyle, and leisure opportunities, as well as contemporary urban development.

The city’s regeneration since the mid-1990s has propelled its growth, transforming it into one of the most dynamic economic centres in the UK. Global employers such as Google and HSBC have been attracted to the city, as well as the BBC in a motion to relocate the entertainment industry from London to Manchester’s MediaCityUK.

曼彻斯特 is also regularly in the global spotlight due to sports and cultural activities such as football. It is home to two of the most famous football clubs in the world, Manchester United and Manchester City. Manchester United is the world’s 4th most valuable football club, regularly hosting sell-out crowds of 85,000+ at their Old Trafford stadium.

The educational institutions in Manchester contribute significantly to its economic growth due to a large student population (more than 100,000), many of whom remain in the city post-graduation to start their careers. The city makes a prestigious feature on the Top 50 Best Student Cities list (QS World University Rankings). This has created a thriving community of young professionals, continually refreshing the local talent pool and driving demand in the rental market.

Manchester’s GDP has grown by 240% since 2000. It generates the largest UK economic output outside of London and is predicted to reach a GDP of GBP58.4 billion by 2035. This economic growth coupled with strong population growth have led to a rise in housing demand.

According to Savills, house prices in Manchester are expected to grow by 21.5% in the next five years. The city is forecast to be one of the best places to invest in property in the UK, ideal for buy-to-let investors.

Explore our properties in 曼彻斯特.

伯明翰, known as the UK's Second City, has demonstrated significant economic growth, with a 121% increase in its economy since 2000 and an anticipated further growth of 60% by 2035.

Despite this economic vitality, Birmingham faces a notable challenge: its housing stock has not kept pace with rapid demographic expansion, resulting in a projected undersupply of at least 26,000 units by 2031. This severe imbalance between housing demand and supply creates a ripe opportunity for Birmingham to be one of the best property investment cities in the UK.

The city's appeal as an investment destination is further enhanced by substantial regeneration projects and infrastructural improvements, including the introduction of the HS2 high-speed railway. This line will dramatically reduce the travel time to London to 45 minutes, enhancing Birmingham's appeal to commuters and potentially increasing demand for residential properties.

As house prices are expected to rise by 19% over the next five years, Birmingham presents a compelling value proposition for investors looking for areas with significant growth potential and current affordability.

View our selection of Birmingham properties.

约克 stands out as one of the best real estate investment cities due to its rich historical background, strategic economic growth, and educational prominence.

It is one of the UK's oldest cities, with roots tracing back to Roman and Viking times, which adds considerable cultural value and attracts around 9 million tourists each year.

This historical attraction is complemented by significant modern developments like the York Central regeneration project, one of the largest regeneration projects in the UK, which promises to transform underutilized areas into vibrant residential, commercial, and cultural districts.

York boasts a strong and dynamic economy, driven in part by its two major universities: the University of York and York St John University. With over 28,000 students annually, these institutions provide a steady stream of young talent and contribute to the local economy through research, innovation, and a skilled workforce.

This strong foundation has fuelled impressive economic growth. Since 2000, York's economy has more than doubled in size, increasing by 112%. This positive trend is expected to continue, with projections indicating a further 89% growth by 2040.

The population of York has grown steadily over the past decade and the city has faced challenges in meeting housing demands, building only an average of 299 new homes annually between 2011 and 2021 despite a need for 877 new homes per year.

This scarcity in supply coupled with strong demand marks York as one of the best places to invest in property, as house prices have grown by 29.2% from 2017 to 2022 and homes sell faster in the city than in nearby cities like 利兹, 利物浦, and 纽卡斯尔.

See what properties we have in 约克.

伦敦 stands as a formidable economic powerhouse, sharing the exclusive Alpha++ city status only with New York City.

As the wealthiest capital in Europe, London’s GDP reached GBP646 billion in 2023, accounting for nearly a quarter of the UK's total GDP. This economic vitality makes London a global hub for international businesses and investors, it also houses one of the world’s best startup ecosystems.

The city is expected to continue to see significant economic growth, with a GDP projected to expand by 90% to GBP1.23 trillion by 2040.

With a population surpassing 9 million and expected to grow by 10% by 2048, and a housing market that suffers from a chronic undersupply —requiring 90,000 to 100,000 homes annually—London remains unchanged as one of the best places to invest in property worldwide as well as in the UK.

London's property market benefits from substantial international interest, particularly in prime central locations, where property sales for GBP5 million and above are reaching record highs.

With forecasts predicting a 13.5% growth in central London property values over the next five years, and a continuous influx of highly educated talent, London’s real estate market offers a robust return on investment through capital appreciation, despite the high entry costs and lower rental yields compared to other regions.

In the rental sector, London exhibits persistent high demand. Rental prices have surged by 31% over the past two years, and occupancy rates in managed properties according to Complete Prime Residential’s portfolio stand at 99.9%.

Looking forward, Savills forecasts a total rental price increase of 18.4% over the next 3 years. This demand is supported by the city's status as a global leader in education and the home of top-tier universities, which attract and retain a large student population and many young working professionals.

Explore our properties in 伦敦.

纽卡斯尔 has redefined itself as a centre for finance, technology, and digital industries, housing over 50,000 businesses and becoming a beacon for knowledge-intensive sectors.

This transformation has not only modernized the city's skyline but also created numerous investment opportunities in the property market. With a 38% increase in GVA since 2010 and a projection to generate GBP10.8 billion by 2030, the city's economy is on a robust upward trajectory.

The city's strategic initiatives, such as the Gigabit City project and the establishment of a major hub for the digital and creative industries, cement Newcastle’s position as a hub of innovation and one of the best property investment cities in the UK.

These efforts are complemented by ambitious regeneration projects like the GBP350 million Newcastle Helix project, which aims to create thousands of jobs and inject substantial economic growth in the long run.

The property market mirrors this growth, having experienced a 30% increase in prices since 2010, with an anticipated further increase of 13.5% over the next five years yet still offering the fifth-best affordability ratio in England and Wales.

Despite numerous development projects, Newcastle faces a persistent housing undersupply, expecting a shortfall of at least 20,500 residential units by 2030, ensuring continued demand and investment opportunities.

The demographic and educational landscape of Newcastle, bolstered by five major universities and a student population of over 100,000, also underscores a strong rental market.

With the property market supported by a growing economy, substantial population growth, and continuous regeneration, Newcastle presents a compelling case for becoming one of the best places to invest in property in the UK, promising solid returns on investment through capital appreciation and rental income.

Discover our properties in 纽卡斯尔.

牛津 is renowned for its prestigious university, which consistently ranks first in the world and attracts a steady flow of international students and foreign capital.

The city is also home to globally recognized art galleries, libraries, UNESCO World Heritage Sites, and museums like the Ashmolean Museum, the oldest university museum in the UK.

Additionally, Oxford is a popular filming location for series like Harry Potter and hosts major cultural venues such as the New Theatre Oxford.

Alongside its vibrant highly intelligent student community, it draws approximately 9 million visitors annually, who participate in a range of festivals and events.

Demographic and economic data underscore Oxford's appeal for property investment. The city is set to continue seeing steady population growth from 136,600 in 2000 to an expected 158,130 residents by 2035.

One-third of Oxford’s population is born outside the UK -it attracts the best talent internationally- and thus has an unemployment rate of 3.3% (2022), lower than the national average.

Oxfordshire's disposable household incomes have grown significantly as a reflection of its highly educated workforce, disposable household incomes have grown from GBP38,260 in 2000 to GBP67,840 in 2022, a 77% increase. Household incomes are forecast to continue growing at a rate of 53%, reaching an incredible GBP104,030 by 2035.

This economic vitality, combined with a solid educational sector and cultural richness, positions Oxford as an attractive city for long-term property investment.

Oxford has seen house prices grow 68% over the past decade and increased 9.7% in 2022 alone. Future forecasts indicate that house prices may rise by another 26% over the next decade, surpassing the UK average.

Take a look at our 牛津 properties.

Leeds, presents a compelling case for one of the best places to invest in property, with its property prices averaging 16% below the national UK average.

As England's second-largest Financial Industries hub, the city has experienced the fastest rate of private-sector job growth of any UK city, supporting a booming economy and a vibrant, youthful demographic.

The city's advantageous location in the northern region of Yorkshire enhances its connectivity and appeal, attracting a skilled workforce and a student population from its four major universities, which in turn drives a strong rental market.

The housing market in Leeds is marked by a significant supply-demand imbalance, with only 27% of the city's housing needs met in recent years.

This shortfall has resulted in a 71% increase in house prices over the last decade according to Oxford Economics, a trend expected to continue with an additional 21% rise projected by 2026.

Despite ongoing regeneration efforts and economic growth—reflected in a GDP increase of 146% since 2000—this under-supply has perpetuated high demand for both rental and purchase properties, making Leeds a prime location for the best property investment opportunities.

Leeds not only thrives as a financial and legal powerhouse but is also emerging as a centre for innovation and business, particularly in the technology and digital sectors.

The city's regeneration projects are enhancing its urban appeal, with developments aimed at modernizing transport and increasing residential and commercial space.

This growth is complemented by Leeds' status as a highly educated city with a large student and graduate population, further bolstering the rental market.

As such, property investors can find significant opportunities in Leeds, with projections of continued economic expansion and property value appreciation.

Liverpool stands out not just for its iconic cultural heritage as the birthplace of The Beatles but also for its dynamic urban transformation.

The city has attracted significant investment through major regeneration initiatives like Liverpool Waters and the Knowledge Quarter, aiming to rejuvenate its waterfront and urban core.

These projects are transforming Liverpool into a nexus for education and innovation, pulling in new businesses and boosting residential development. Coupled with persistent housing undersupply, these factors create ripe investment opportunities, promising both capital appreciation and robust rental demand.

Financially, Liverpool remains an appealing market due to its relative affordability compared to other major UK cities.

The city's population has been steadily growing, supported by its economic expansion and the influx of over 50,000 students across four universities, maintaining a high demand for housing. This ongoing growth is not keeping pace with new construction, indicating a sustained opportunity for investment in the housing sector.

The rental market in Liverpool is particularly strong, supported by a significant student population and an increasing number of young professionals moving to the city for its thriving digital and creative industries.

Rental yields have been impressive, with IP Global’s properties in the city seeing returns as high as 7%.

This robust rental market, when combined with Liverpool's economic resilience and the cultural appeal of a city known as a UK leader in digital and creative sectors, makes it an ideal location for property investors looking for steady, reliable returns suggesting it is one of the best places for property investment in the UK.

Belfast property prices are rising the fastest in the UK in 2025, primarily due to a significant increase in Northern Ireland as a whole, with a 6.9% growth in house prices.

This growth contrasts with many other regions, where house prices have either fallen or grown at a much slower pace. This growth is underpinned by strong economic fundamentals.

Belfast’s economy has seen impressive growth, growing by 46% since 2000 and projected to increase a further 33% by 2040.

In tandem, the population has also increased by 33% since 2000, with an additional 11% expected by 2040. This population increase creates steady demand for housing, putting upward pressure on prices.

Recent price corrections have improved affordability in the Belfast and Northern Ireland’s property market, attracting new buyers and contributing to a more robust property sector (Zoopla). This enhances the overall investment proposition and marks Belfast as one of the best property investment opportunities in the UK.

Glasgow stands out as Scotland's largest city and a significant economic hub. According to recent economic forecasts, Glasgow is expected to contribute significantly to Scottish GDP growth in 2025, with estimates suggesting that the Glasgow City Region could contribute around a third of Scotland's overall output, with growth rates potentially exceeding the national average.

Glasgow is home to over 48,000 businesses, making it a pivotal area for economic activity and job creation in Scotland. Particularly notable is Glasgow’s status as the top UK Core City for producing graduates in Financial and Business Services, many of whom stay in the city, thereby strengthening the local financial sector. This retention of skilled graduates fuels a demand for housing, supporting a robust property market.

The Glasgow Metropolitan Area is anticipated to see substantial population growth, expected to increase by 175,000 over the next 15 years, aligning its growth rate with global cities like New York, Los Angeles, and Paris.

This demographic expansion is set to drive demand in both the housing and rental markets, making Glasgow one of the best places for property investment in the UK.

The city's economic forecast is equally promising, with GDP expected to nearly double to GBP 58.7 billion by 2040, indicating sustained economic growth and investment potential.

In terms of real estate, Glasgow's property market is on a strong upward trajectory, with property prices expected to rise by 14.2% and rental prices by 15.3% over the next five years.

This growth in property value, coupled with the city’s economic and demographic trends, presents a compelling case for property investment in Glasgow.

Investors can anticipate robust returns driven by a growing population, a booming economy, and a vibrant financial sector, positioning Glasgow as a premier choice for the best property investment in Scotland.

See our properties in Glasgow.

The UK property market's landscape is marked by regional disparities, with notable growth in the North and challenges in the South.

Factors such as economic expansion, housing undersupply, and population growth form the backbone of the investment case for the highlighted markets.

For investors, these dynamics underscore the importance of selecting the best property investment markets with strong fundamentals and future growth potential.

Partnering with a knowledgeable investment firm like IP Global, equipped with comprehensive market research and a strategic approach, can guide investors towards making informed decisions in these promising UK property markets.

There are 3 underlying economic fundamentals that make a strong investment case for residential real estate.

A city with an expanding population, a strong GDP and rising salaries as well as a shortage of appropriate housing will naturally put pressure on the housing market, causing prices and rents to rise.

Let's take a look at some of the latest statistics compiled by Oxford Economics, ONS and JLL that make Manchester's investment case strong.

Greater Manchester is a metropolitan county in North West England and is home to 2,854,540 people.

It includes ten metropolitan boroughs: Bolton, Bury, Oldham, Rochdale, Stockport, Tameside, Trafford, Wigan, and the cities of Salford and Manchester.

It is one of the country's largest metropolitan regions, and the second-most populous area in England, outside of London, as of 2021.

Due to its large population, Greater Manchester is one of the most economically diverse regions in the UK and is one of the main drivers of the northern economy.

At present, there are approximately 1.4 million jobs that contribute towards Greater Manchester’s GVA of GBP67.2 billion (2021).

The Greater Manchester area generates nearly 40% of total output (GVA) in the North West and 19% across the North of England. Manchester, Salford and Trafford have seen the largest growth over the last 21 years, contributing 56% of Greater Manchester’s GVA in 2021.

Demographics

Manchester underwent a significant transformation during the Industrial Revolution, attracting entrepreneurs and manufacturers in abundance. The population grew consistently year-on-year until the 1960s, when a number of manufacturing jobs began moving to countries with significantly lower costs. This ushered in a period of economic decline and depopulation for Manchester.

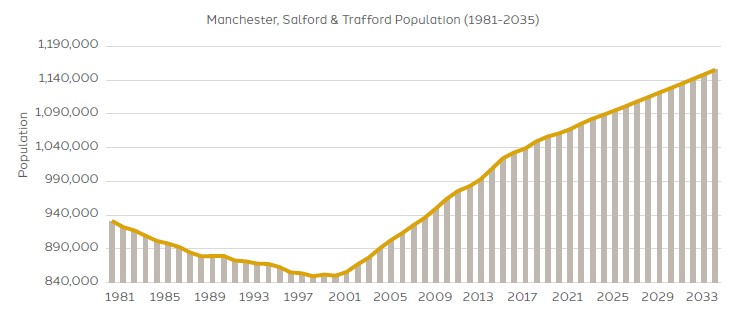

The trend persisted until the early 2000s, when a combination of natural population growth and inward migration (as a result of renewed economic growth), saw the number of residents in the area begin to rise once again. Manchester’s working population has increased by 25% in the last 20 years, compared to the UK national average of 11%. Manchester City is currently the 5th most populous city in the UK, registering 558,840 residents as of 2021. Combined with Trafford and Salford, the total population for the area is expected to reach more than 1,154,970 by 2035, a 36% increase since 2000.

经济

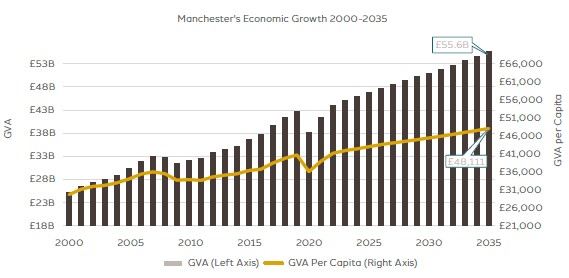

As a result of successful economic initiatives such as the Northern Powerhouse project, Manchester’s GVA has grown by 63% since 2000, totalling GBP41.3 billion as of 2021. Following a small dip in 2021 due to the global pandemic, the economy is expected to produce GBP55.6 billion per annum by 2035. At the same time, average GVA per capita has risen 31% since 2000 and is expected to increase by a further 24%, reaching GBP48,111 by 2035.

Employment & Incomes

The city of Manchester is the economic hub of the Northern Powerhouse. Residents have therefore experienced significant wealth gains, with average household disposable incomes increasing by 92% between 2001 and 2021. This trend is expected to continue, with households seeing a further 51% gain over the next 14 years.

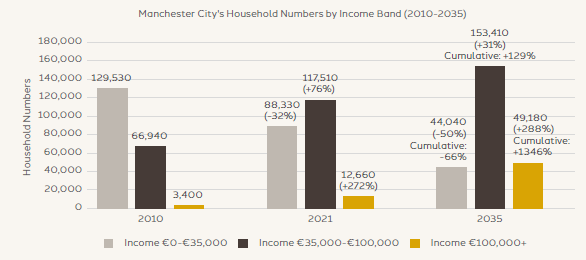

The number of households in the city earning less than EUR35,000 per year is declining at a rapid rate. At the same time, the number of households entering the middle-and-upper-income bands is rising dramatically. By 2035, the number of households in the higher income brackets will have grown by 288% since 2021 and 1,346% cumulatively since 2010.

房地产市场

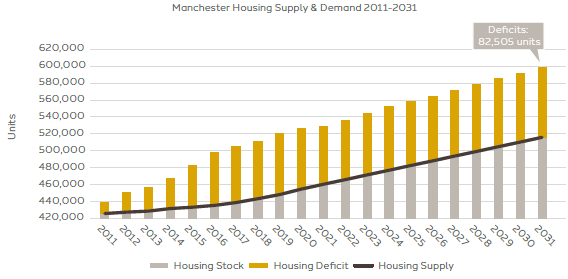

Despite the considerable progress in construction activity, the housing supply has been unsuccessful in meeting demand. Since 2011, 37,460 units were added to the housing stock, which totalled 455,015 units as of 2020. As a result, there is a substantial undersupply of homes, with just 34% of the city’s housing needs fulfilled over the past 9 years.

By 2031, an undersupply of at least 82,505 housing units is anticipated, taking the previous backlog into account.

Due to a consistently undersupplied housing market combined with substantial economic growth. In 2000, an average Manchester house was just £41,625, and today it's £241,956 – a 481% jump in the past 25 years. Manchester house prices are expected to continue to rise, with some predicting growth of 18.8% to 19.3% by 2026 and 2028, respectively. This is due to a combination of factors including increased demand, limited supply, and new investment.

In January 2025, the average private rent in Manchester was £1,300 per month, which is an 11.1% increase from the previous year, according to the Office for National Statistics (ONS).

A healthy population growth rate coupled with an undersupplied housing market have made Manchester an ideal opportunity for investment -but not all investments are made equal.

Speak to a Wealth Manager at IP Global about the other factors to look for before purchasing a property in Manchester.

Take a look at our opportunities that have been through rigorous due diligence to meet the standards IP Global sets in order to invest our own funds alongside our clients in Manchester.

Choosing the best places to buy property in the UK is key to maximising investment returns, as market trends vary across regions. IP Global’s insights help investors identify high-potential locations, making sure their investments aligns with strong growth opportunities while mitigating risks.

Whether you're searching for the best city to invest in property in the UK or looking for emerging hotspots, our strategic guides help you towards smart, profitable decisions.

Choosing the best places to invest in property is just as crucial as selecting the property itself when it comes to real estate investment. The location determines not only the potential return on investment through appreciation but also affects the property's demand, rental rates, and overall desirability.

Key factors that make a city or town the best place to invest in property include:

- Economic Growth: A strong and expanding local economy with job growth and low unemployment rates attracts more residents, boosting demand for housing.

- Infrastructure Regeneration: Investment in transportation, utilities, and public services that improves the quality of life and accessibility can increase property values.

- Population Trends: Areas experiencing population growth are likely to see increased demand for housing, both rental and owned.

- Real Estate Market Trends: Stable or increasing property values and rental yields indicate a healthy real estate market.

- Schools and Educational Institutions: Locations with access to quality education are highly desirable for families, which supports sustained demand.

- Proximity to Amenities: Easy access to shopping, dining, entertainment, and recreational facilities makes a location more appealing to potential residents.

- Public Transportation: Efficient public transport options can significantly enhance property appeal, particularly in urban areas.

曼彻斯特, 伯明翰, 利兹, 纽卡斯尔, 利物浦, and 谢菲尔德 stand out as some of the best places to invest in property in the UK, each with unique attributes that contribute significantly to their economic and cultural profiles. These cities are vital economic centres with diverse industries. The financial data supporting this analysis comes from the Office for National Statistics (ONS), as well as Oxford Economics and Zoopla.

Manchester is recognised as the powerhouse of the North of England and boasts a thriving arts and cultural scene alongside one of the UK's largest student populations, totalling over 100,000 students. This vibrant atmosphere is further energised by the city's deep-rooted football culture, with two major clubs attracting over 40,000 fans each week.

Beyond its cultural and sporting significance, Manchester is also a key economic hub, home to a rapidly expanding business sector and large multinational corporations, particularly within tech, finance, and media. Major regeneration projects, such as the £1 billion transformation of Mayfield and the continued expansion of MediaCityUK, further boost the city's investment appeal.

The property market in Manchester is particularly appealing for investors, featuring an average house price of GBP245,000, a monthly rent of GBP1,300, which has seen an 11.1% increase from the previous year, and an impressive average rental yield of 6.53%, according to Zoopla. These factors create a robust environment for property investments.

With its strong economy, high rental yields, and ongoing infrastructure developments, Manchester continues to stand out as one of the best cities to invest in property in the UK.

Visit our Manchester investment property guide today.

Birmingham, the UK's second-largest city, has an economy worth GBP38 billion, the most robust outside London, making it a prime location for property investment. The city is also one of the country's youngest, with five universities and over 80,000 students, contributing to a strong rental market. Birmingham’s strategic location at the heart of the UK, coupled with its excellent transport links, including the HS2 high-speed rail project, further enhances its appeal by improving connectivity and driving economic growth.

The city has undergone significant regeneration, with projects such as Paradise Birmingham, the Big City Plan, and the transformation of Smithfield attracting businesses, residents, and investors alike. These developments, alongside the relocation of major corporations like HSBC and PwC, have strengthened Birmingham’s status as a key business hub.

Current real estate statistics are promising for investors looking for the best places to buy property in the UK: the average house price is GBP232,000, the average monthly rent is GBP1,043, an 8.4% increase from the previous year, and the average rental yield stands at 6.1%. These numbers highlight Birmingham’s growing demand for rental properties and its potential for solid investment returns. This makes Birmingham one of the best places to buy property in the UK.

For more information on Birmingham, visit our Birmingham investment property guide.

Leeds stands out as one of the best places to invest in the UK, having been recognized as the ‘best city to live and work in the North of England’ in 2021. The city's economic strength is bolstered by being home to the second-largest banking and finance sector in the UK, creating a wealth of job opportunities and attracting high-income professionals. This influx not only strengthens the local economy but also drives demand for quality housing, making it an attractive prospect for property investors.

In addition to its thriving financial sector, Leeds is undergoing significant transformation. The Leeds South Bank regeneration project is set to expand the city’s size substantially, with plans to create 35,000 jobs and develop over 8,000 new homes, further solidifying Leeds as an investment hotspot. Major infrastructure developments, such as HS2’s proposed integration and continued investment in transport links, are also expected to enhance connectivity and boost property demand.

The property market in Leeds presents compelling figures for investors: the average house price is £245,000, the average monthly rent is £1,095, a 2.5% increase from the previous year’s £1,000, and the average rental yield is 6.67%. With strong capital appreciation potential and rising rental demand, Leeds remains a prime location for buy-to-let investors.

With its expanding economy, ambitious redevelopment plans, and high rental yields, Leeds continues to establish itself as one of the best cities to invest in property in the UK.

For more investment information on Leeds, visit our Leeds investment property guide.

Newcastle is emerging as one of the best locations for property investment in the UK, particularly due to the Teesside Freeport, the largest in the UK. Its proximity to Newcastle enhances the city's appeal as a business hub, attracting companies and boosting employment. The region's economic outlook is further strengthened by large-scale infrastructure projects and government investment, positioning Newcastle as a growing hotspot for both businesses and residents.

Additionally, Newcastle's tech and digital economy has expanded by over 51% since 2013, bringing a significant influx of professionals and increasing housing demand.

The city is also home to a strong student population, with two leading universities, Newcastle University and Northumbria University, contributing to high demand for rental properties.

These developments are reflected in the local property market, with an average house price of £201,000, an average monthly rent of £1,030, a 6.6% increase from the previous year, and an attractive average rental yield of 7.45%. With continued regeneration efforts, rising rental demand, and a competitive property market, Newcastle presents strong growth potential for investors.

For more insights into why Newcastle is considered one of the best cities to invest in property in the UK, explore our full Newcastle investment guide today.

Liverpool is a compelling choice for the best places to buy property in the UK, driven by its extensive urban regeneration and vibrant cultural scene. The city has seen significant redevelopment projects like the Lime Street regeneration, which includes a new 412-bedroom student block, 30,000 square feet of commercial space, and a 101-bedroom hotel.

This ongoing revitalization enhances the city's appeal and functionality. Furthermore, Liverpool is a leading UK student destination with three central universities and over 70,000 students, creating a steady demand for rental properties. The city also benefits from the international appeal of Liverpool and Everton FC, Premier League teams whose games attract tens of thousands of spectators and further spotlight the city globally.

These factors, combined with an average house price of GBP176,000, an average monthly rent of GBP826, an 9.8% increase from the previous year, and a robust average rental yield of 7.44%. The city's affordability, combined with strong capital appreciation potential and high rental demand, makes it one of the most promising locations for property investment in the UK.

With a thriving economy, growing population, and major regeneration projects driving property market growth, Liverpool is widely regarded as one of the best cities to invest in property in the UK.

Learn more about why Liverpool is a top investment destination in our Liverpool investment guide.

Sheffield is a strong choice for the best places to buy property in the UK, boasting a growth rate of 11% since 2000, and being the country's fourth-largest city with a population of 571,630. Known for its rich industrial heritage, Sheffield has evolved into a modern economic hub with thriving sectors in advanced manufacturing, technology, and finance.

The job market in Sheffield is supported by major companies like Siemens, HSBC, Boeing, and IBM, which enhances employment opportunities and increases demand for housing. Also, the city is home to two major universities, the University of Sheffield and Sheffield Hallam University, which contribute to a growing student and graduate population, further fuelling the rental market.

The average house price in Sheffield is GBP217,000, and the rental market is also performing well, with an average monthly rent of GBP873, up 6.4% from the previous year. With an average rental yield of 6.38%, Sheffield offers solid prospects for investors looking for dependable returns.

With ongoing regeneration projects, improved transport links, and a strong local economy, Sheffield presents a well-balanced investment opportunity.

To learn more about why Sheffield is considered one of the best cities to invest in property in the UK, read our full Sheffield investment guide.

Understanding the best investment strategy is essential before purchasing a buy-to-let property. Student property investment, involving renting to students through purpose-built accommodations or HMOs, capitalizes on steady demand in university towns, making it one of the best places to buy property in the UK. Residential investment is another strong option, where an investor buys a house or flat to rent to tenants, known for its potential for long-term growth and consistent rental yields.

Ultimately, the choice of investment strategy should align with the individual’s goals and market conditions in the best places to invest in property in the UK.

Determining the best place to buy property in the UK largely depends on your investment goals and budget. For those aiming for high rental returns, cities like Manchester and Newcastle stand out as prime options. These cities offer vibrant student populations and a continuous influx of young professionals, which keep demand for rental properties high. As a result, these locations are often cited among the best places to invest in property in the 英国, specifically for those interested in achieving strong and steady rental income.

On the other hand, if the goal is long-term capital growth, Liverpool and Manchester are noteworthy choices. Both cities have been undergoing significant regeneration, leading to an increase in property values over time. Liverpool, in particular, has seen extensive redevelopment which has transformed the cityscape and boosted its appeal as a residential area. Manchester continues to attract a high level of investment in both commercial and residential development, solidifying its reputation as one of the best property investments in the 英国.

Each city offers unique opportunities, and the choice should be guided by thorough research into the specific market dynamics and potential future developments in each location.

At IP Global, we have a track record of investing over USD3 billion in 18 countries, which has given us the expertise to make investing with us the smoothest end-to-end experience, something that can be a daunting adventure. Go to our contact us page to find out more about how we can help.

Investing in buy-to-let properties has long been a popular strategy for individuals looking to generate passive income, build wealth, and diversify their portfolios. But with changing regulations, tax implications, and shifting market trends, many investors are asking: Is buy-to-let still worth it?

A buy-to-let property is a type of real estate investment where an individual purchases a property with the intention of renting it out rather than living in it. This allows the owner to earn rental income while potentially benefiting from long-term property appreciation.

For those searching for buy-to-let properties for sale, it’s essential to understand the key financial and regulatory aspects of this investment strategy before making a purchase.

Finding a Property – Investors look for buy-to-let properties for sale in high-demand areas with strong rental yields and capital growth potential.

Financing the Investment – Most investors use a buy-to-let mortgage, which differs from a standard residential mortgage as lenders assess rental income potential rather than just personal income.

Generating Rental Income – Once the property is tenanted, landlords collect monthly rent, which ideally covers mortgage repayments, maintenance, and other costs.

Capital Growth – Over time, property values may increase, allowing landlords to sell for a profit.

This means that when searching for a buy-to-let property for sale, investors must factor in this additional cost.

With increasing taxes, stricter lending regulations, and rising interest rates, many investors are asking: Buy-to-let, is it worth it?

Steady Rental Income – A well-located property can provide consistent monthly cash flow.

Long-Term Capital Growth – Property values tend to appreciate over time, increasing the overall return on investment.

Diversification – Buy-to-let properties add a tangible asset to an investment portfolio, reducing reliance on stocks and other financial instruments.

Demand for Rentals – With homeownership becoming less affordable, rental demand remains high, particularly in cities like London, Manchester, and Birmingham.

While challenges exist, buy-to-let can still be a profitable investment if approached correctly. Investors should:

If you’re looking for a buy-to-let property for sale, consider these UK hotspots:

If you’re searching for buy-to-let properties for sale, these cities offer some of the best opportunities in 2025.

Before purchasing a buy-to-let UK property, consider the following:

🔹 地理位置 – Areas with strong employment rates, good transport links, and high rental demand yield the best returns.

🔹 Mortgage Options – Compare interest rates and lender requirements for property buy-to-let financing.

🔹 Rental Yields – Calculate expected rental income versus purchase price and expenses.

🔹 Tax Implications – Beyond buy-to-let stamp duty, landlords must pay income tax on rental earnings and capital gains tax on property sales.

🔹 Management Costs – If you don’t plan to manage the property yourself, factor in letting agent fees.

Owning a buy-to-let property comes with responsibilities, including:

For those who prefer a hands-off approach, hiring a property management company can help.

Buy-to-let properties remain an attractive option for investors who:

Choose the right location with strong rental demand.

Optimize tax efficiency to mitigate costs.

Secure competitive mortgage rates to maximize returns.

If you’re serious about buy-to-let properties for sale, now is the time to research, plan, and take action. The UK property market still offers significant opportunities—if you invest wisely.

If you're looking for buy-to-let properties for sale, start by identifying high-yield areas, securing financing, and understanding your tax obligations. With careful planning, buy-to-let UK investments can still offer solid returns in 2025 and beyond.

Sheffield, a vibrant city in the heart of northern England, has transformed into a hub of opportunities, combining academic prestige, entrepreneurial spirit, and a flourishing cultural scene. From its world-renowned universities to its celebrated art and music offerings, Sheffield stands out as a city with a lifestyle that appeals to students, young professionals, and families alike.

Once hailed as the steel manufacturing capital of the world, Sheffield has embraced modernity while preserving its industrial heritage. Today, it is home to a growing population of businesses, professionals, and residents. This growth has been a catalyst for economic revival and has fueled a forward-moving real estate market, making the city increasingly attractive to both homeowners and property investors.

Sheffield proudly holds the title of one of the greenest cities in Europe. The ‘S’ postcode boasts over two million trees, 250 parks, and unparalleled proximity to the stunning landscapes of the Peak District National Park. Whether you are seeking outdoor adventures or a peaceful lifestyle surrounded by nature, Sheffield provides an exceptional balance between urban living and natural beauty.

The city’s appeal doesn’t end there. It offers seamless connectivity to major motorways and transport networks, providing easy access to other cities and regions in the UK. Sheffield is regarded as one of the safest cities in the country, further enhancing its reputation as an ideal place to live and invest. It’s no surprise that the city continues to attract new residents year after year.

Sheffield has been on a steady growth trajectory since the early 2000s. Thanks to economic initiatives introduced by the Labour government, the city’s population began expanding significantly. In 2001, Sheffield had a population of 513,390. By 2024, that number had risen to 579,840. Projections estimate that by 2040, the population will reach 630,650—a 23% increase since the start of the century.

This sustained growth is putting increasing pressure on the city’s housing stock. As more people are drawn to Sheffield for its opportunities, quality of life, and affordability, the demand for housing is set to remain high, presenting significant opportunities for investors and developers.